On March 1, Year 1, Gilmore Incorporated declared a cash dividend on its 1,500 outstanding shares of $50 par value, 6% preferred stock. The dividend will be paid on May 1, Year 1 to the stockholders of record as of April 1, Year 1.

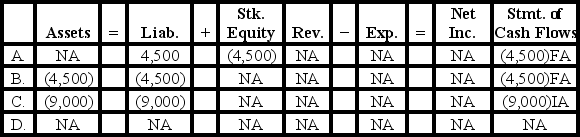

-How will the May 1 payment of the dividend affect the elements of the financial statements?

Definitions:

Adjoining Landowner

A person or entity that owns land sharing a boundary with a specific piece of property.

Fee Simple

A legal term referring to the most comprehensive ownership in real estate, which gives the holder full possessory rights and obligations indefinitely.

Crown Patent

A legal document issued by a sovereign government granting rights or land to an individual or entity, historically used to transfer public lands into private ownership.

Possessory Nuisance

A situation where a person’s use or possession of property negatively impacts a neighbor's right to enjoy their property.

Q7: Which of the following statements best describes

Q12: Indicate whether each of the following statements

Q29: The net realizable value of accounts receivable

Q36: Within how many days after initially commencing

Q44: Which of the following statements about Treasury

Q47: Libby is an hourly employee who earns

Q54: As of December 31,Year 1,Gant Corporation had

Q62: Which of the following correctly shows the

Q69: What is the difference between termination and

Q77: On January 1,Year 1,Dalen Company purchased office