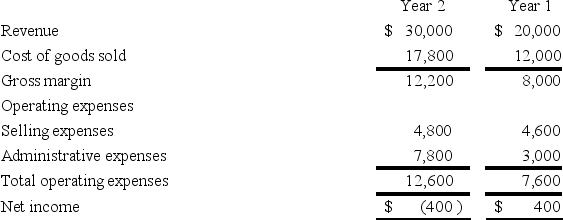

The following are the income statements of the Hancock Company for two consecutive years.Increases in which of the expenses contributed to the net loss in Year 2?

Definitions:

Income Tax Rate

The percentage at which an individual or corporation is taxed on its income, with the rate often varying based on the level of income.

Initial Investments

The initial amount of money invested in a project, asset, or company to cover setup costs or purchase capital assets.

Working Capital

The difference between current assets and current liabilities, indicating the liquidity available to fund day-to-day operations.

Income Tax Rate

The percentage of income that is paid to the government as tax.

Q6: What factor distinguishes an employee from an

Q6: The employees of Able Company have worked

Q23: Which factor has removed most of the

Q23: Eagle Company recently petitioned for bankruptcy and

Q29: Refer to the above information.On the statement

Q33: On October 1,Year 1,Harrison Company borrowed money

Q46: Which of the following describes the effects

Q57: What is the net realizable value of

Q59: At the end of the Year 2

Q105: Flagler Company purchased equipment that cost $90,000.The