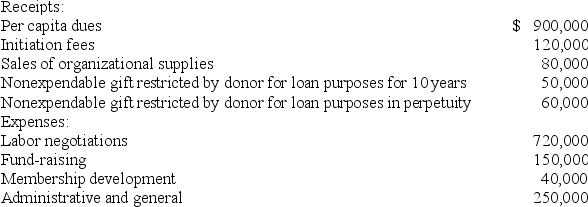

Golden Path,a labor union,had the following receipts and expenses for the year ended December 31,20X8:

The union's constitution provides that 12 percent of the per capita dues be designated for the strike insurance fund to be distributed for strike relief at the discretion of the union's executive board.

The union's constitution provides that 12 percent of the per capita dues be designated for the strike insurance fund to be distributed for strike relief at the discretion of the union's executive board.

-Based on the information provided,in Golden Path's statement of activities for the year ended December 31,20X8,what amount should be reported under the classification of revenue from funds without donor restrictions?

Definitions:

"Do Not Disturb" Sign

A notice placed on a door to indicate that the person inside does not wish to be disturbed.

Bed Rest

A medical recommendation to stay in bed for therapeutic reasons for a period of time, often to promote healing or recovery.

Visually Impaired

A term describing individuals who have reduced vision that cannot be corrected to normal levels through usual means such as glasses or contact lenses.

Braille Sticker

Adhesive labels embossed with Braille characters that can be attached to various objects, aiding visually impaired individuals in identifying them.

Q10: Based on the preceding information,what amount will

Q30: On December 1,Year 1,Jack's Snow Removal Company

Q37: A trustee has been appointed for Smith

Q42: A private,not-for-profit hospital received the following restricted

Q52: Based on the preceding information and assuming

Q56: During the third quarter of 20X4,Ripley Company

Q66: JJ Co.purchased on account merchandise with a

Q70: Refer to the above information.Which of the

Q82: A business and the person who owns

Q85: A company may recognize a revenue or