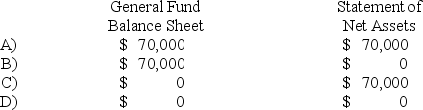

The general fund of Reston acquired computer equipment costing $70,000 during the fiscal year ended June 30,20X9.Machinery and Equipment should be reported in Reston's General Fund Balance Sheet and government-wide Statement of Net Assets at June 30,20X9,as follows:

Definitions:

Net Income

The total revenue of a company minus its expenses, taxes, and the cost of goods sold, indicating the company's profit.

Accumulated Depreciation

The total amount of depreciation expense that has been recorded for an asset since it was put into use.

Indirect Method

A way of preparing a cash flow statement where net income is adjusted for changes in balance sheet accounts to calculate cash flow from operating activities.

Operating Activities

Transactions and events related to the primary operations of a business, such as revenue from sales and expenses from operations.

Q5: Upon arrival in Chile,Karen exchanged $1,000 of

Q20: Based on the preceding information,which of the

Q31: The following information was obtained from the

Q34: Form 8-K<br>A)Provides preliminary information to investors about

Q37: Refer to the information given.Assuming a current

Q45: Based on the preceding information,what amount will

Q47: Transferable interest of a partner includes all

Q57: When a new partner is admitted into

Q70: What is the company's return-on-equity ratio?<br>A)5%<br>B)10%<br>C)20%<br>D)50%

Q75: All of a business's temporary accounts appear