Bill,Page,Larry,and Scott have decided to terminate their partnership.The partnership's balance sheet at the time they decide to wind up is as follows:

During the winding up of the partnership,the other assets are sold for $150,000 and the accounts payable are paid.Page and Larry are personally solvent,but Bill and Scott are personally insolvent.The partners share profits and losses in the ratio of 4:2:1:3.

During the winding up of the partnership,the other assets are sold for $150,000 and the accounts payable are paid.Page and Larry are personally solvent,but Bill and Scott are personally insolvent.The partners share profits and losses in the ratio of 4:2:1:3.

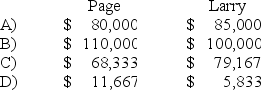

-Based on the preceding information,what amount will be distributed to Page and Larry upon liquidation of the partnership?

Definitions:

Ingratiation

A psychological technique where an individual attempts to become more attractive or likable to another, often through flattery or praise.

Self-Monitoring

The extent to which individuals regulate their behavior to fit the demands of social situations, being aware of how they are perceived by others.

Unrequited Love

Love that is not openly reciprocated or understood as such by the beloved.

Harass

To subject someone to repeated or persistent unwelcome behavior, causing distress or discomfort.

Q12: Which regulation created the Securities and Exchange

Q22: Based on the preceding information,if no goodwill

Q26: Liabilities are obligations of a business to

Q28: Santa Fe Company was started on January

Q42: A debt service fund for the City

Q47: Frank Company earned $15,000 of cash revenue.Which

Q50: Which resource providers lend financial resources to

Q57: Warren Enterprises began operations during Year 1.The

Q57: In a town's general fund operating budget

Q74: Based on the preceding information,at the end