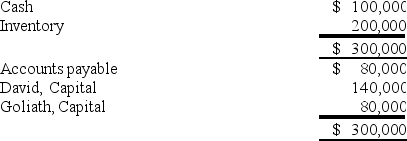

Partners David and Goliath have decided to liquidate their business.The following information is available:

David and Goliath share profits and losses in a 3:1 ratio,respectively.During the first month of liquidation,half the inventory is sold for $70,000,and $50,000 of the accounts payable are paid.During the second month,the rest of the inventory is sold for $55,000,and the remaining accounts payable are paid.Cash is distributed at the end of each month,and the liquidation is completed at the end of the second month.

David and Goliath share profits and losses in a 3:1 ratio,respectively.During the first month of liquidation,half the inventory is sold for $70,000,and $50,000 of the accounts payable are paid.During the second month,the rest of the inventory is sold for $55,000,and the remaining accounts payable are paid.Cash is distributed at the end of each month,and the liquidation is completed at the end of the second month.

-Refer to the information provided above.How much cash will be distributed to Goliath at the end of the second month?

Definitions:

Mutations

Changes in the nucleotide sequences of the genetic material of an organism, which can lead to variations in physical and functional traits.

HIV

A virus known as Human Immunodeficiency Virus targets the immune system, potentially causing Acquired Immunodeficiency Syndrome (AIDS) without proper treatment.

Sexual Transmission

The process by which infections or diseases are spread through sexual contact between individuals.

MSM

An acronym for "men who have sex with men," used to describe a behavior that impacts public health without specifying sexual orientation.

Q3: Based on the information provided,what is the

Q11: Based on the information provided,what is the

Q15: The governance of a corporation includes the

Q25: Which division of the SEC develops and

Q34: For which of the following long-term debt

Q36: What account should be debited in the

Q43: Based on the preceding information,the entries on

Q58: Based on the information provided,what amount of

Q76: A private,not-for-profit hospital received a donation of

Q106: On June 30,20X9,a voluntary health and welfare