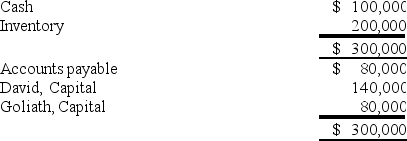

Partners David and Goliath have decided to liquidate their business.The following information is available:

David and Goliath share profits and losses in a 3:1 ratio,respectively.During the first month of liquidation,half the inventory is sold for $70,000,and $50,000 of the accounts payable are paid.During the second month,the rest of the inventory is sold for $55,000,and the remaining accounts payable are paid.Cash is distributed at the end of each month,and the liquidation is completed at the end of the second month.

David and Goliath share profits and losses in a 3:1 ratio,respectively.During the first month of liquidation,half the inventory is sold for $70,000,and $50,000 of the accounts payable are paid.During the second month,the rest of the inventory is sold for $55,000,and the remaining accounts payable are paid.Cash is distributed at the end of each month,and the liquidation is completed at the end of the second month.

-Refer to the information provided above.Assume instead that the remaining inventory was sold for $20,000 in the second month.What payments will be made to David and Goliath at the end of the second month?

Definitions:

Generally Accepted Accounting Principles

A set of standards, principles, and procedures that guide the accounting practices and financial reporting in the U.S.

Income Statement

A financial statement that reports a company's financial performance over a specific accounting period, detailing revenue, expenses, and net income.

Balance Sheet

A document detailing a business's financial status at a given moment, listing the company's resources, debts, and owner's equity.

Adjusting Entries

Adjusting entries are journal entries made in the accounting records at the end of an accounting period to allocate income and expenditures to the period in which they actually occurred.

Q9: For a subsidiary to be eligible to

Q11: Based on the information provided,what is the

Q11: Based on the information given above,what amount

Q20: Sometimes the recognition of revenue is accompanied

Q23: Barcode Corporation acquired 70% of the common

Q37: A trustee has been appointed for Smith

Q40: Begin with the information provided,but assume instead

Q53: Based on this information,what was the amount

Q90: When a company purchases a depreciable asset,it

Q96: Refer to the above information.On the statement