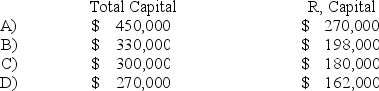

RD formed a partnership on February 10,20X9.R contributed cash of $150,000,while D contributed inventory with a fair value of $120,000.Due to R's expertise in selling,D agreed that R should have 60 percent of the total capital of the partnership.R and D agreed to recognize goodwill.What is the total capital of the RD partnership and the capital balance of R after the goodwill is recognized?

Definitions:

Milling Machine

A machine tool used to shape solid materials by removing excess material through rotary cutters.

Existing Capacity

Current maximum level of output or production that a facility can achieve under normal conditions.

Additional Minute

Additional Minute refers to any extra time accounted for or needed beyond what was initially planned or scheduled, often in context to services or operations.

Most Profitable

Describes a scenario, product, or entity generating the highest profit margin or net income compared to others in a comparative set.

Q7: Which of the following items are likely

Q9: Company X denominated a December 1,20X9,purchase of

Q10: Based on the information provided,what is the

Q14: The DEF partnership reported net income of

Q31: The Securities Exchange Act of 1934 requires

Q46: Based on the preceding information,what is the

Q48: Companies issuing stock to the public have

Q51: Based on the preceding information,what amount will

Q62: When the local currency of a foreign

Q114: "Classification of contributions restricted by purpose" describes