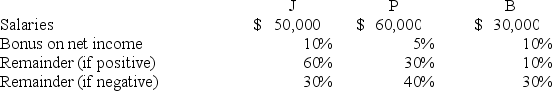

The JPB partnership reported net income of $160,000 for the year ended December 31,20X8.According to the partnership agreement,partnership profits and losses are to be distributed as follows:

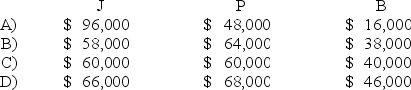

How should partnership net income for 20X8 be allocated to J,P,and B?

Definitions:

Operating Income

Income generated from regular business operations, excluding costs of goods sold and other operating expenses.

Stockholders' Equity

The residual interest in the assets of a corporation that remains after deducting its liabilities, representing ownership interest.

Interest Expense

The cost incurred by an entity for borrowed funds, reflecting the interest payments due on any form of debt.

Tax Expense

The amount of money that a company owes in taxes based on its net income, adhering to the tax laws of the jurisdictions in which it operates.

Q10: Based on the information provided,what is the

Q25: Which division of the SEC develops and

Q34: Interim income statements are required for Smith

Q34: Refer to the above information.Assuming Ski's FCU

Q38: Under Chapter 11 proceedings,what represents the fair

Q42: Based on the information given above,what was

Q58: In 20X6,Dorian City received $15,000,000 of bond

Q62: When the local currency of a foreign

Q62: Refer to the above information.Which of the

Q70: Refer to the above information.Which of the