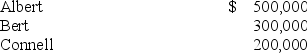

In the ABC partnership (to which Daniel seeks admittance) ,the capital balances of Albert,Bert,and Connell,who share income in the ratio of 5:3:2 are:

-Based on the preceding information,what amount of goodwill will be recorded if Daniel invests $450,000 for a one-third interest?

Definitions:

Sons of Liberty

A group of patriots formed in the North American British colonies to protest against British taxation and laws, known for their role in the American Revolution.

Tea Act

A 1773 British law that granted the East India Company the right to sell tea to the American colonies free of the taxes that colonial tea sellers had to pay, leading to the Boston Tea Party.

Great Britain's Right

The inherent or legal privileges, freedoms, or authority that Great Britain claims or exercises, often in a historical or legal context.

Stamp Act

A 1765 British tax imposed on the American colonies, requiring them to pay a tax on printed materials, which sparked widespread protest.

Q1: Based on the preceding information,what is the

Q18: Which sections of the cash flow statement

Q18: In cases of operations located in highly

Q40: Apple and Betty are planning on beginning

Q43: Which of the following observations concerning claims

Q47: Based on the information provided,while preparing the

Q61: Based on the preceding information,in the journal

Q62: Which of the following items would not

Q74: The Town of Pasco has no supplies

Q91: The restricted funds of a not-for-profit hospital