In the AD partnership,Allen's capital is $140,000 and Daniel's is $40,000 and they share income in a 3:1 ratio,respectively.They decide to admit David to the partnership.Each of the following questions is independent of the others.

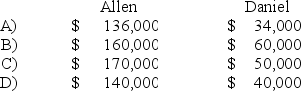

-Refer to the information provided above.David directly purchases a one-fifth interest by paying Allen $34,000 and Daniel $10,000.The land account is increased before David is admitted.What are the capital balances of Allen and Daniel after David is admitted into the partnership?

Definitions:

Accurate Identification

The process of correctly recognizing and naming someone or something.

Eyewitness Testimony

Evidence provided by individuals who were present during an event, based on their observations and memories.

Impaired Vision

Reduced or limited ability to see, which can range from slight visual difficulties to legal blindness.

Match-To-Culprit Approach

A strategy used in criminal investigations where potential suspects are compared to available evidence to identify a match.

Q11: On March 15,20X9,Clarion Company paid property taxes

Q34: Based on the preceding information,in the consolidating

Q35: On a debtor-in-possession income statement,which of the

Q39: PeopleMag sells a plot of land for

Q42: Based on the preceding information,the entry to

Q51: The adjusted trial balance for White River

Q52: Dividends paid by a company are reported

Q55: The City of Fargo issued general obligation

Q56: All of the following stockholders' equity accounts

Q57: In a town's general fund operating budget