In the AD partnership,Allen's capital is $140,000 and Daniel's is $40,000 and they share income in a 3:1 ratio,respectively.They decide to admit David to the partnership.Each of the following questions is independent of the others.

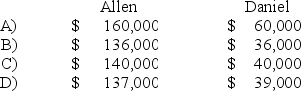

-Refer to the information provided above.David invests $40,000 for a one-fifth interest in the total capital of $220,000.What are the capital balances of Allen and Daniel after David is admitted into the partnership?

Definitions:

Limited Partnership

A form of partnership consisting of at least one general partner who manages the business and assumes legal debts and obligations, and one or more limited partners who are liable only to the extent of their investments.

General Partner

An owner of a partnership who is actively involved in its management and has unlimited personal liability for the business debts.

Business Management

The activities associated with running a company, such as planning, organizing, directing, and controlling, to achieve business objectives.

Borrowing Money

Borrowing money involves obtaining funds from another party with the promise to repay the principal amount along with interest or other financial charges.

Q5: Dragon Company has two reportable segments,A and

Q7: How would a company report a change

Q8: Portuguese owns 80 percent of the common

Q19: The balance sheet given below is presented

Q20: Based on the information provided,what is the

Q20: Based on the preceding information,in the preparation

Q30: Based on the preceding information,which of the

Q33: Based on the information given above,what amount

Q49: The terms of a partnership agreement provide

Q69: Refer to the above information.Tiffany is paid