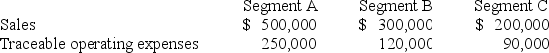

Tuttle Company discloses supplementary operating segment information for its three reportable segments.Data for 20X3 are available as follows:

Allocable costs for the year were $54,000.Allocable costs are assigned based on the ratio of a segment's income before allocable costs to total income before allocable costs.The 20X3 operating profit for Segment A was:

Definitions:

Q13: Mint Corporation has several transactions with foreign

Q14: Mason Company paid its annual property taxes

Q16: Customary Review<br>A)Provides preliminary information to investors about

Q19: Based on the preceding information,in the journal

Q24: Based on the preceding information,what amount will

Q26: Liabilities are obligations of a business to

Q29: The general fund of the City of

Q34: Which of the following accounts could be

Q35: On a debtor-in-possession income statement,which of the

Q72: Carlisle established a motor vehicle service and