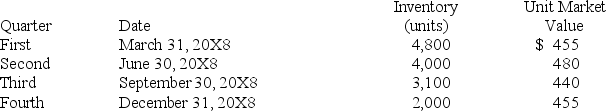

Forge Company,a calendar-year entity,had 6,000 units in its beginning inventory for 20X8.On December 31,20X7,applying the lower-of-cost-or-market (NRV) principle,the units had been adjusted down to $470 per unit from an actual cost of $510 per unit.It was the lower of cost or market (NRV) .No additional units were purchased during 20X8.The following additional information is provided for 20X8:

Forge does not have sufficient experience with the seasonal market for its inventory units and assumes that any reductions in market value during the year will be permanent.

Forge does not have sufficient experience with the seasonal market for its inventory units and assumes that any reductions in market value during the year will be permanent.

-Based on the preceding information,the cost of goods sold for the year 20X8,is:

Definitions:

Intellectual Property

Legal rights that result from intellectual activity in the industrial, scientific, literary, and artistic fields.

Royalties

Payments made by one party to another for the right to use intellectual property, such as music, books, or patents, on an ongoing basis.

Creative Destruction

Creative destruction is an economic concept describing the process by which new innovations lead to the demise of older technologies or businesses, thereby fostering growth and economic progress.

Economic Profits

The difference between total revenue and total costs, including both explicit and implicit costs, indicating the financial gain in excess of the opportunity costs.

Q5: Upon arrival in Chile,Karen exchanged $1,000 of

Q13: Based on the information given above,what will

Q20: Under the temporal method,which of the following

Q27: Refer to the information provided above.Using a

Q37: Refer to the information given above.What amount

Q47: During the fiscal year ended June 30,20X9,the

Q58: Based on the information provided,what amount of

Q59: The general fund of the City of

Q70: For which of the following funds are

Q96: Refer to the above information.On the statement