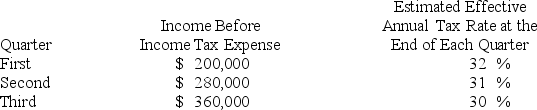

Toledo Imports,a calendar-year corporation,had the following income before tax expense and estimated effective annual income tax rates for the first three quarters in 20X8:

Toledo's income tax expense in its interim income statement for the nine months ended September 30 and for the third quarter,respectively,are:

Definitions:

Total Cost

The sum of all expenses incurred in the production of goods or services, including fixed and variable costs.

Profit-Maximizing

The process or strategy undertaken by a company to increase its profits to the highest possible level.

Loss-Minimizing

A strategy employed by businesses to reduce financial losses under unfavorable market conditions, often by cutting costs or restructuring operations.

Average Total Cost

The total cost of production (fixed plus variable costs) divided by the number of units produced, giving a per-unit cost of production.

Q1: Based on the information given above,what amount

Q3: On the statement of functional expenses prepared

Q10: Which of the following funds should use

Q39: Based on the information provided,what is the

Q39: Consolidated financial statements tend to be most

Q45: Based on the information provided,what is the

Q48: Revenues from parking meters and parking fines

Q49: Samuel Corporation foresees a downturn in its

Q51: Refer to the information provided above.What amount

Q62: Which of the following items would not