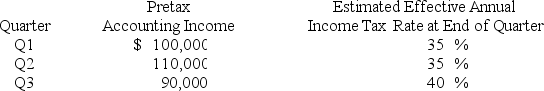

William Corporation,which has a fiscal year ending January 31,had the following pretax accounting income and estimated effective annual income tax rates for the first three quarters of the year ended January 31,20X8:

William's income tax expense in its interim income statement for the third quarter are:

Definitions:

Retirement Of Debt

The process of paying off debt obligations, either by making scheduled payments or through a lump-sum payment.

Cash Flows

The total amount of money being transferred into and out of a business, particularly affecting the company's liquidity.

Significant Noncash

Transactions that have a significant impact on the financial statements but do not involve cash flow, often reported in financial statement notes.

Statement Of Cash Flows

A financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents, breaking the analysis down to operating, investing, and financing activities.

Q3: A wholly owned subsidiary sold land to

Q12: Refer to the information provided above.Jacob and

Q16: Based on the information given above,what amount

Q18: A private,not-for-profit hospital expended $35,000 of net

Q24: Accounting and Auditing Enforcement Releases<br>A)Provides preliminary information

Q37: Refer to the above information.Which of the

Q49: Based on the information given above,what is

Q54: Perimeter,Inc.acquired 30 percent of South Co.'s (South)voting

Q55: Operand Corporation reported consolidated revenues of $30,000,000

Q63: Based on the preceding information,in the entry