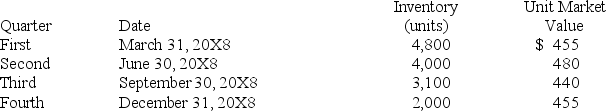

Forge Company,a calendar-year entity,had 6,000 units in its beginning inventory for 20X8.On December 31,20X7,applying the lower-of-cost-or-market (NRV) principle,the units had been adjusted down to $470 per unit from an actual cost of $510 per unit.It was the lower of cost or market (NRV) .No additional units were purchased during 20X8.The following additional information is provided for 20X8:

Forge does not have sufficient experience with the seasonal market for its inventory units and assumes that any reductions in market value during the year will be permanent.

Forge does not have sufficient experience with the seasonal market for its inventory units and assumes that any reductions in market value during the year will be permanent.

-Based on the preceding information,the cost of goods sold for the second quarter is:

Definitions:

Total Fixed Costs

The overall total of expenditures that remain steady, unaffected by how much is produced or outputted.

Average Fixed Costs

The constant production costs (unaffected by changes in output) divided by the production volume.

Swords

Swords are bladed weapons used historically and today for ceremonial, martial, or symbolic purposes, characterized by long blades for slashing or thrusting.

Average Total Cost

The total cost of production (fixed plus variable costs) divided by the quantity of output produced.

Q3: During the fiscal year ended June 30,20X9,an

Q8: Based on the preceding information,the journal entry

Q9: Based on the preceding information,what was the

Q13: Based on the information provided,the gain on

Q28: Assuming there is a budget surplus,which of

Q33: The City of Edmond established a capital

Q38: Based on the preceding information,what is the

Q39: Briefly explain the three classes of creditors

Q47: One of the major objectives of ASC

Q55: Refer to the above information.What is each