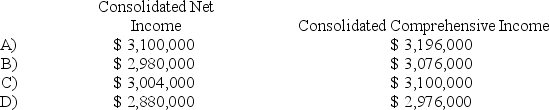

Seattle,Inc.owns an 80 percent interest in a Portuguese subsidiary.For 20X8,Seattle reported income from operations of $2.0 million.The Portuguese company's income from operations,after foreign currency translation,was $1.1 million.The foreign currency translation adjustment was $120,000 (credit) .Consolidated net income and consolidated comprehensive income for the year are:

Definitions:

Group Legal Services

Legal support and services provided to a group of individuals, often as a benefit from an employer or membership organization.

Flexible Benefits Program

An employee benefits plan that allows individuals to choose from a variety of options to create a package tailored to their personal needs.

Benefit Audits

The process of reviewing and verifying the accuracy and compliance of an organization's employee benefits program with relevant laws, policies, and contracts.

Claiming Habits

Patterns or tendencies of individuals or groups in asserting or establishing their rights, entitlements, or possessions, often in legal or business contexts.

Q2: A loss on the constructive retirement of

Q16: An enterprise fund of Grist was billed

Q23: Barcode Corporation acquired 70% of the common

Q33: Based on the information provided,the equity-method income

Q37: At the end of the year,a parent

Q44: The costs of enterprise fund activities are

Q47: Based on the information provided,while preparing the

Q53: Based on the information provided,in Golden Path's

Q65: The City of Ames uses the consumption

Q74: On January 1,20X1,Washington City received $200,000 from