On January 2,20X8,Polaris Company acquired a 100% interest in the capital stock of Ski Company for $3,100,000.Any excess cost over book value is attributable to a patent with a 10-year remaining life.At the date of acquisition,Ski's balance sheet contained the following information:

Ski's income statement for 20X8 is as follows:

Ski's income statement for 20X8 is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

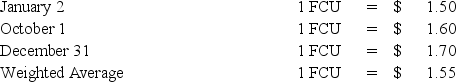

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming Ski's FCU is the functional currency,what is the amount of translation adjustment that appears on Polaris's consolidated financial statements at December 31,20X8?

Definitions:

Internal Revenue Code

A comprehensive, codified set of laws that govern federal tax administration in the United States.

Political Activity

Actions or efforts aimed at influencing government policy or the election of candidates for political office.

House Rule 25

A specific regulation or policy within an organization or institution, often relating to governance or operational procedures, though the content can vary widely depending on the context.

Lobbyists

Individuals or groups hired to influence lawmakers, regulation, or policies in favor of the entity that employs them, often through direct contact or advocacy.

Q16: Quantum Company imports goods from different countries.Some

Q21: Lloyd Corporation reports the following information for

Q22: Based on the preceding information,if no goodwill

Q40: Which of the following classes of information

Q40: Begin with the information provided,but assume instead

Q46: Based on the preceding information,what should be

Q48: Companies issuing stock to the public have

Q52: Based on the preceding information,income taxes payable

Q62: Based on the information given above,what inventory

Q64: All of the following are management tools