On January 2,20X8,Polaris Company acquired a 100% interest in the capital stock of Ski Company for $3,100,000.Any excess cost over book value is attributable to a patent with a 10-year remaining life.At the date of acquisition,Ski's balance sheet contained the following information:

Ski's income statement for 20X8 is as follows:

Ski's income statement for 20X8 is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

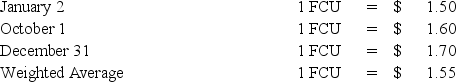

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming Ski's FCU is the functional currency,what is the balance in Polaris's investment in foreign subsidiary account at December 31,2008?

Definitions:

RRIF

Registered Retirement Income Fund, a tax-deferred retirement plan in Canada that an individual can use to generate income from the assets inside their Registered Retirement Savings Plan.

Compounded Annually

Interest calculated once a year on both the initial principal and the accumulated interest from previous periods.

Compounded Monthly

Interest on an investment or loan calculated and added to the principal balance monthly, where each month's interest calculation includes the previous month's interest.

Deferred Annuity

A financial security provided by insurers that holds back the distribution of income, either through regular installments or a one-time sum, until it's opted for by the investor.

Q5: Received cash contributions restricted by donors for

Q18: Based on the information given above,what amount

Q20: ASC 280,Disclosure about Segments of an Enterprise

Q24: If the functional currency is the local

Q32: Assume Push sold the inventory to Shove.Using

Q36: Based on the information given above,what amount

Q45: Based on the information provided,what is the

Q45: Which of the following are established by

Q46: Based on the preceding information,what amount will

Q62: The disclosure,"net assets released from restrictions," is