On January 2,20X8,Polaris Company acquired a 100% interest in the capital stock of Ski Company for $3,100,000.Any excess cost over book value is attributable to a patent with a 10-year remaining life.At the date of acquisition,Ski's balance sheet contained the following information:

Ski's income statement for 20X8 is as follows:

Ski's income statement for 20X8 is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

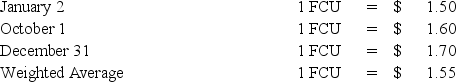

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming the U.S.dollar is the functional currency,what is Polaris's remeasurement gain (loss) for 20X8? (Assume the ending inventory was acquired on December 31,20X8. )

Definitions:

Issues Management

The process of identifying, analyzing, and responding to issues that could potentially impact an organization's reputation and operations.

Recovery Stage

In crisis management, the recovery stage is the phase where an organization begins to recover from a crisis, focusing on restoring operations, repairing damages, and improving relationships with stakeholders to regain trust.

Coombs' Three-Stage Model

A crisis communication framework that outlines three phases—pre-crisis, crisis, and post-crisis—for managing an organization's response to a crisis.

Crisis Communications

The strategies and actions taken by an organization to communicate effectively during times of crisis to manage its reputation.

Q3: On the statement of functional expenses prepared

Q17: Based on the information given above,what amount

Q31: Pisa Company acquired 75 percent of Siena

Q34: Based on the preceding information,what will be

Q35: Shue,a partner in the Financial Brokers Partnership,has

Q37: Refer to the above information.Which of the

Q40: The following information pertains to property taxes

Q41: Simon Company has two foreign subsidiaries.One is

Q42: Based on the preceding information,what amount of

Q46: Refer to the above information.Tiffany is paid