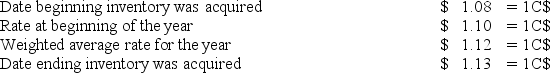

The Canadian subsidiary of a U.S.company reported cost of goods sold of 50,000 C$,for the current year ended December 31.The beginning inventory was 15,000 C$,and the ending inventory was 10,000 C$.Spot rates for various dates are as follows:

Assuming the U.S.dollar is the functional currency of the Canadian subsidiary,the remeasured amount of cost of goods sold that should appear in the consolidated income statement is

Definitions:

Double Layer

A double layer often refers to structures composed of two levels of material, which in biological contexts, could imply the phospholipid bilayer of cell membranes or protective coatings.

Joint Surface

The part of a bone that articulates with another bone, usually covered with cartilage to enable smooth movements.

Synovial Joint

A type of joint that is surrounded by a fluid-filled capsule, allowing for smooth movement between bones.

Most Movable

Refers to joints with the greatest range of motion, such as the ball-and-socket joints of the shoulder and hip.

Q6: Which of the following is true? When

Q9: Refer to the above information.Assuming the U.S.dollar

Q21: Based on the information provided,what amount will

Q26: Briefly explain the following terms associated with

Q30: Based on the preceding information,in the journal

Q34: Based on the information provided,what was the

Q36: Based on the preceding information,the journal entry

Q46: Based on the preceding information,what should be

Q46: Based on the preceding information,income tax expense

Q54: On January 1,20X7,Pepper Company acquired 90 percent