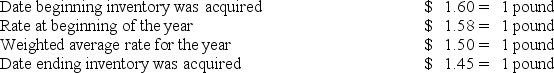

The British subsidiary of a U.S.company reported cost of goods sold of 75,000 pounds (sterling) for the current year ended December 31.The beginning inventory was 10,000 pounds,and the ending inventory was 15,000 pounds.Spot rates for various dates are as follows:

Assuming the pound is the functional currency of the British subsidiary,the translated amount of cost of goods sold that should appear in the consolidated income statement is:

Definitions:

Manufacturing Margin

The difference between the sales revenue generated from manufactured goods and the cost of goods sold (COGS), highlighting the profitability of manufacturing activities.

Variable Costing

An accounting method that includes only variable production costs (direct materials, direct labor, and variable manufacturing overhead) in product costs and treats fixed manufacturing overhead as a period cost.

Operating Income

Income generated from regular business operations, excluding revenues and expenses from non-operating activities.

Inventory

The overall quantity of products and materials in possession of a company, intended for future sale or to be used in manufacturing.

Q13: Based on the information provided,the gain on

Q21: Refer to the information provided above.David invests

Q39: Based on the information provided,what amount will

Q40: Based on the preceding information,what amount of

Q42: Based on the information given above,what was

Q47: During the fiscal year ended June 30,20X9,the

Q57: Which of the following funds use the

Q57: Based on the preceding information,what is the

Q72: "Financial statement of a private NFP entity"

Q102: Refer to the above information.At June 30,20X9,the