On January 2,20X8,Polaris Company acquired a 100% interest in the capital stock of Ski Company for $3,100,000.Any excess cost over book value is attributable to a patent with a 10-year remaining life.At the date of acquisition,Ski's balance sheet contained the following information:

Ski's income statement for 20X8 is as follows:

Ski's income statement for 20X8 is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

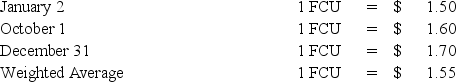

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming Ski's FCU is the functional currency,what is the amount of translation adjustment that appears on Polaris's consolidated financial statements at December 31,20X8?

Definitions:

Significant Achievement

A considerable or noteworthy accomplishment that marks progress toward a goal.

Purpose

The reason for which something is done or created or for which something exists.

Value-based Management

Value-based management is a business management strategy focused on maximizing shareholder value through the alignment of company processes, resources, and initiatives toward this objective.

Economic Value

The maximum amount a consumer is willing to pay for an item minus the actual price of the item.

Q5: Based on the information given above,what amount

Q16: Based on the information given above,what amount

Q27: Based on the information given above,what amount

Q28: A citizen of Minersville purchased a truck

Q30: Based on the preceding information,the amount to

Q34: On July 25,20X8,the city of Pullman,which reports

Q44: All of the following are elements of

Q51: When there are intercompany sales of inventory

Q57: The assets listed below of a foreign

Q72: Carlisle established a motor vehicle service and