On January 2,20X8,Polaris Company acquired a 100% interest in the capital stock of Ski Company for $3,100,000.Any excess cost over book value is attributable to a patent with a 10-year remaining life.At the date of acquisition,Ski's balance sheet contained the following information:

Ski's income statement for 20X8 is as follows:

Ski's income statement for 20X8 is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

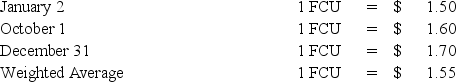

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming the U.S.dollar is the functional currency,what is Polaris's remeasurement gain (loss) for 20X8? (Assume the ending inventory was acquired on December 31,20X8. )

Definitions:

Clear, Well-Defined Goals

Specific, articulate objectives that are straightforward to understand and aim to achieve.

Goal Commitment

The determination and dedication an individual shows towards achieving their set objectives.

Feedback

Information provided about the result of an action or process, used as a basis for improvement.

Cognitive Reevaluation

Involves changing the way one thinks about a situation in order to alter its emotional impact.

Q11: Based on the preceding information,what journal entry

Q13: Based on the information given above,what is

Q23: Based on the information provided,what amount of

Q38: Refer to the information provided above.Using a

Q49: Pie Company acquired 75 percent of Strawberry

Q53: Estimated gross profit rates may be used

Q56: A debt service fund of Clifton received

Q59: Based on the preceding information,in the entry

Q60: Saltaire Co.is a French company located in

Q68: When a new partner is admitted into