On January 2,20X8,Polaris Company acquired a 100% interest in the capital stock of Ski Company for $3,100,000.Any excess cost over book value is attributable to a patent with a 10-year remaining life.At the date of acquisition,Ski's balance sheet contained the following information:

Ski's income statement for 20X8 is as follows:

Ski's income statement for 20X8 is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

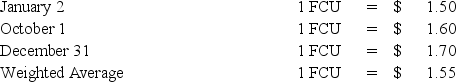

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming the U.S.dollar is the functional currency,what is the amount of Ski's cost of goods sold remeasured in U.S.dollars?

Definitions:

Spin-Offs

Products or shows that have been derived from an existing product, show, or franchise, often to further explore a character, storyline, or theme.

Modern Media Companies

Contemporary organizations that produce, distribute, or provide access to content across various platforms, including digital.

Services

Economic activities that provide intangible products, such as entertainment, healthcare, and education, to consumers or businesses.

Media Producers

Individuals or companies responsible for creating and overseeing the production of media content, such as films, television shows, or online content.

Q8: Received cash contributions restricted by donors for

Q26: Based on the preceding information,the investment elimination

Q27: The Salmon Corporation (Salmon)reported net income for

Q36: Based on the information given above,what amount

Q37: Based on the information given above,what amount

Q47: Based on the information given above,what amount

Q48: Fixed assets and investments are reported in

Q53: Based on the information given above,what will

Q85: ASC 958 requires that an "other not-for-profit

Q96: Refer to the above information.On the statement