On January 2,20X8,Polaris Company acquired a 100% interest in the capital stock of Ski Company for $3,100,000.Any excess cost over book value is attributable to a patent with a 10-year remaining life.At the date of acquisition,Ski's balance sheet contained the following information:

Ski's income statement for 20X8 is as follows:

Ski's income statement for 20X8 is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

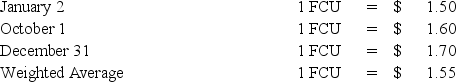

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming the U.S.dollar is the functional currency,what is Ski's net income for 20X8 in U.S.dollars (include the remeasurement gain or loss in Ski's net income) ?

Definitions:

Selected Accounts

Accounts chosen for review or analysis, often for the purpose of financial reporting or auditing.

Normal Credit Balance

The expected positive balance of certain types of accounts in the double-entry bookkeeping system, such as liabilities, revenues, and equity accounts.

Sales Tax Payable

A liability account in the general ledger that accumulates the amount of sales tax collected from customers on behalf of local or state tax authorities, to be remitted in the future.

Estimated Returns Inventory

A reserve account used by companies to account for anticipated returns of sold goods, affecting the overall sales and inventory levels.

Q1: On a partner's personal statement of financial

Q8: Missoula Corporation disposed of one of its

Q8: Portuguese owns 80 percent of the common

Q9: On January 1,20X9,Peanuts Corporation acquired 80 percent

Q17: On March 15,20X7,Barrel Company paid property taxes

Q21: Which of the following financial statements would

Q22: Based on the preceding information,what amount of

Q38: Based on the information given above,in the

Q68: Received a multi-year pledge,with cash being received

Q115: In a private,not-for-profit hospital,which fund would record