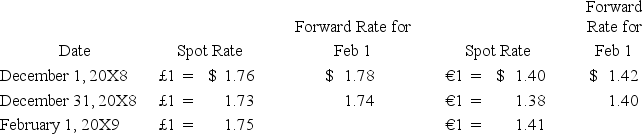

On December 1,20X8,Hedge Company entered into a 60-day speculative forward contract to sell 200,000 British pounds (£) at a forward rate of £1 = $1.78.On the same day it purchased a 60-day speculative forward contract to buy 100,000 euros (€) at a forward rate of €1 = $1.42.

The rates are as follows:

Hedge had no other speculation transactions in 20X8 and 20X9.Ignore taxes.

Hedge had no other speculation transactions in 20X8 and 20X9.Ignore taxes.

-Based on the preceding information,what is the effect of the British pound speculative contract on 20X8 net income?

Definitions:

Theme Fonts

A set of coordinating fonts used for titles and body text within a document or presentation theme.

Theme Colors

A predefined set of colors chosen to create a consistent look and feel across a document, presentation, or interface, typically part of a theme or design template.

Reference

Information that is used to support statements, theories, or work, often cited in academic and professional contexts.

Macro

A programmed rule or set of commands that automates complex or repetitive tasks within software applications.

Q9: Consolidated net income may include the parent's

Q32: Trevor Company discloses supplementary operating segment information

Q36: Based on the preceding information,in the consolidation

Q38: On January 1,20X7,Pepper Company acquired 90 percent

Q38: Tanner Company,a subsidiary acquired for cash,owned equipment

Q38: Based on the information given above,in the

Q42: Refer to the information given above.What amount

Q46: Based on the preceding information,what should be

Q65: Two sole proprietors,L and M,agreed to form

Q69: Refer to the above information.Tiffany is paid