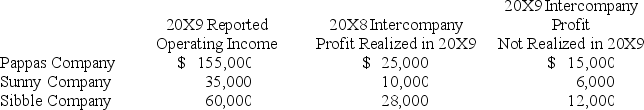

Pappas Company owns 85 percent of Sunny Company's stock and 80 percent of Sibble Company's stock.All acquisitions were made at book value.The fair values of noncontrolling interests at the time of acquisition were equal to the proportionate share of the book values of the companies.The companies file a consolidated tax return each year and in 20X9 paid a total tax of $112,000.Each company is involved in a number of intercompany inventory transfers each period.Information on the companies' activities for 20X9 is as follows:

Pappas Company does not record income tax expense on income from subsidiaries because a consolidated tax return is filed.

Pappas Company does not record income tax expense on income from subsidiaries because a consolidated tax return is filed.

-Based on the information provided,what amount of consolidated net income will be reported for the year 20X9?

Definitions:

Basic Fiber

Fundamental optical fiber used in telecommunications to transmit data over long distances at high speeds.

Firm's Profitability

A financial metric indicating the degree to which a company generates profit from its operations.

Overall Impact

The total effect or significance of an event, decision, or action on a system, organization, or community.

Increase Competition

A situation where more competitors enter the market, intensifying the competitive environment.

Q6: Refer to the information given above.What amount

Q15: Based on the preceding information,what is the

Q19: Assume Shove sold the inventory to Push.Using

Q21: Based on the preceding information,in the preparation

Q22: Based on the preceding information,what is Highland's

Q29: The general fund of the City of

Q33: Refer to the above information.If the other

Q46: Based on the preceding information,income tax expense

Q51: Which worksheet consolidating entry will be made

Q56: All of the following stockholders' equity accounts