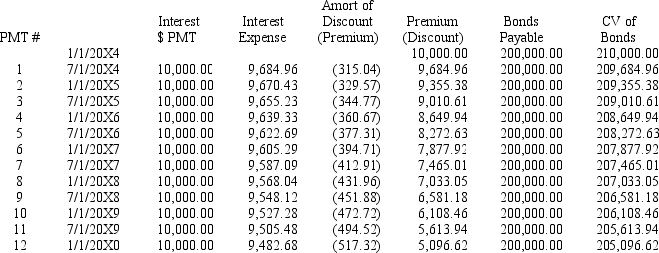

Spice Company issued $200,000 of 10 percent first mortgage bonds on January 1,20X4,at 105.The bonds mature in 10 years and pay interest semiannually on January 1 and July 1.Pumpkin Corporation purchased $140,000 of Spice's bonds from the original purchaser on December 31,20X8,for $125,000.Pumpkin owns 75 percent of Spice's voting common stock.Spice's partial bond amortization schedule is as follows:

-Based on the information given above,what amount of premium on bonds payable will be eliminated in the preparation of the December 31,20X8 consolidated financial statements?

Definitions:

Operating Section

In the context of financial reporting, this term specifies the portion of the cash flow statement that deals with cash flows from operational activities.

Cash Inflow

This is money coming into a business or entity from operations, financing, or investing activities.

Accounts Receivable

Money owed to a company by its customers from sales or services rendered on credit.

Accounts Payable

Amounts a company owes to suppliers for goods or services that have been received but not yet paid for.

Q3: Deductions from gross pay in the payroll

Q13: Pratt Corporation acquired 90 percent of Splatt

Q15: Pants Company and Shirt Company both produce

Q20: ASC 280,Disclosure about Segments of an Enterprise

Q25: Refer to the information provided.Assume instead that

Q26: Based on the preceding information,what amount of

Q31: Based on the preceding information,what is the

Q31: Refer to the information given.Assuming a current

Q31: Based on the preceding information,in the journal

Q34: Based on the information given above,what amount