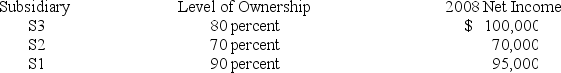

Parent Corporation purchased land from S1 Corporation for $220,000 on December 26,20X8.This purchase followed a series of transactions between P-controlled subsidiaries.On February 15,20X8,S3 Corporation purchased the land from a nonaffiliate for $160,000.It sold the land to S2 Company for $145,000 on October 19,20X8,and S2 sold the land to S1 for $197,000 on November 27,20X8.Parent has control of the following companies:

Parent reported income from its separate operations of $200,000 for 20X8.

Parent reported income from its separate operations of $200,000 for 20X8.

-Based on the preceding information,at what amount should the land be reported in the consolidated balance sheet as of December 31,20X8?

Definitions:

Raw Materials Production Needs

The quantity and type of raw materials required to meet production targets based on the designed product and manufacturing processes.

Raw Materials Cost

The expense associated with acquiring the unprocessed materials required in the manufacture of products.

Cash Collected

The total amount of money received from sales, services, or other business activities.

Accounts Receivable Balance

The total amount of money owed to a company by its customers for goods or services that have been delivered or used but not yet paid for.

Q5: According to the provisions of the Sarbanes-Oxley

Q7: On December 1,20X8,Denizen Corporation entered into a

Q9: Based on the preceding information,in the preparation

Q11: Peta Corporation and its subsidiary reported consolidated

Q11: All of the following are benefits the

Q18: Based on the preceding information,the investment elimination

Q22: Based on the preceding information,under the acquisition

Q39: Prepare a schedule providing a proof of

Q51: Refer to the information provided above.What amount

Q55: Based on the preceding information,at what dollar