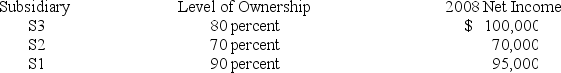

Parent Corporation purchased land from S1 Corporation for $220,000 on December 26,20X8.This purchase followed a series of transactions between P-controlled subsidiaries.On February 15,20X8,S3 Corporation purchased the land from a nonaffiliate for $160,000.It sold the land to S2 Company for $145,000 on October 19,20X8,and S2 sold the land to S1 for $197,000 on November 27,20X8.Parent has control of the following companies:

Parent reported income from its separate operations of $200,000 for 20X8.

Parent reported income from its separate operations of $200,000 for 20X8.

-Based on the preceding information,at what amount should the land be reported in the consolidated balance sheet as of December 31,20X8?

Definitions:

Neatness

The quality of being clean, orderly, and well-organized, often reflecting on one's personal habits or the presentation of their work.

Curiosity

A natural desire for knowledge and understanding that drives individuals to explore, investigate, and learn.

Role Overload

The condition in which the demands placed on a person by his or her roles exceed the amount of time, energy, and other resources available to meet those demands.

Terminally Ill

A condition in which a patient is suffering from a disease or illness for which there is no cure and is expected to result in the death of the patient.

Q4: Based on the information provided,income to the

Q8: Which of the following usually does not

Q13: Based on the preceding information,what amount of

Q34: Based on the information provided,what was the

Q35: Company Pea owns 90 percent of Company

Q35: Based on the preceding information,in the journal

Q38: Based on the preceding information,what is the

Q52: Derby Company pays its executives a bonus

Q57: The assets listed below of a foreign

Q59: Based on the preceding information,in the entry