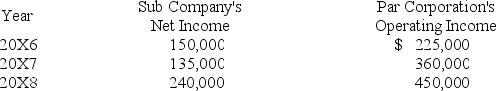

Sub Company sells all its output at 20 percent above cost to Par Corporation.Par purchases its entire inventory from Sub.The incomes reported by the companies over the past three years are as follows:

Sub Company sold inventory for $300,000,$262,500 and $337,500 in the years 20X6,20X7,and 20X8 respectively.Par Company reported ending inventory of $105,000,$157,500 and $180,000 for 20X6,20X7,and 20X8 respectively.Par acquired 70 percent of the ownership of Sub on January 1,20X6,at underlying book value.The fair value of the noncontrolling interest at the date of acquisition was equal to 30 percent of the book value of Sub Company.

Sub Company sold inventory for $300,000,$262,500 and $337,500 in the years 20X6,20X7,and 20X8 respectively.Par Company reported ending inventory of $105,000,$157,500 and $180,000 for 20X6,20X7,and 20X8 respectively.Par acquired 70 percent of the ownership of Sub on January 1,20X6,at underlying book value.The fair value of the noncontrolling interest at the date of acquisition was equal to 30 percent of the book value of Sub Company.

-Based on the information given above,what will be the income assigned to controlling interest for 20X7?

Definitions:

Nucleotide Bases

Organic molecules that serve as the fundamental building blocks of nucleic acids, like DNA and RNA, consisting of adenine, thymine (or uracil in RNA), cytosine, and guanine.

Histamine

A compound that is involved in local immune responses, as well as regulating physiological functions in the gut and acting as a neurotransmitter for the brain, spinal cord, and uterus.

Membrane Channels

Proteins in cell membranes that regulate the passage of ions and molecules in and out of the cell, playing crucial roles in cell signaling and homeostasis.

Ions

Atoms or molecules that have gained or lost one or more electrons, resulting in a net positive or negative electric charge.

Q1: In 20X6 and 20X7,each of Putney Company's

Q8: Which of the following usually does not

Q9: At the time that the entry is

Q19: If an employer pays unemployment taxes to

Q21: Based on the preceding information,what amount would

Q29: Based on the preceding information,what amount of

Q33: On September 3,20X8,Jackson Corporation purchases goods for

Q45: Based on the preceding information,what balance would

Q49: Based on the preceding information,the consolidating entry

Q54: Based on the preceding information,in the preparation