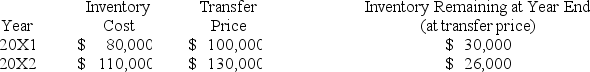

Push Company owns 60% of Shove Company's outstanding common stock.Intra-entity sales are as follows:

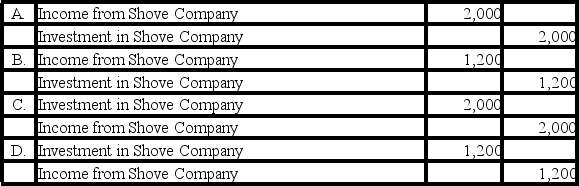

-Assume Shove sold the inventory to Push.Using the fully adjusted equity method,what journal entry would be recorded by Push to recognize the realization of the 20X1 deferred intercompany profit and to defer the 20X2 unrealized gross profit on inventory sales to Shove?

Definitions:

Financial Capital

Economic resources measured in terms of money used by entrepreneurs and businesses to buy what they need to make their products or provide their services.

Intellectual Capital

The intangible value of a company's assets such as knowledge, brand, reputation, and employee competence.

Money Market Fund

A type of mutual fund that invests in high-quality, short-term debt instruments, cash, and cash equivalents and is considered to be relatively low risk.

Portfolio Management

The art and science of making decisions about investment mix and policy, matching investments to objectives, asset allocation for individuals and institutions, and balancing risk against performance.

Q6: Staff Accounting Bulletins<br>A)Provides preliminary information to investors

Q13: If the employer has made timely deposits

Q13: During the year a parent makes sales

Q18: Services performed in the employ of a

Q25: Given the increased development of complex business

Q31: Based on the information provided,at the time

Q35: Based on the preceding information,what was the

Q35: Currently,none of the states imposes an unemployment

Q43: Follett Company incurred a first quarter operating

Q45: Pisa Company acquired 75 percent of Siena