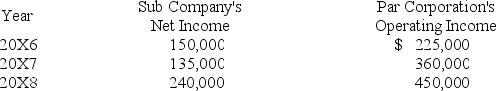

Sub Company sells all its output at 20 percent above cost to Par Corporation.Par purchases its entire inventory from Sub.The incomes reported by the companies over the past three years are as follows:

Sub Company sold inventory for $300,000,$262,500 and $337,500 in the years 20X6,20X7,and 20X8 respectively.Par Company reported ending inventory of $105,000,$157,500 and $180,000 for 20X6,20X7,and 20X8 respectively.Par acquired 70 percent of the ownership of Sub on January 1,20X6,at underlying book value.The fair value of the noncontrolling interest at the date of acquisition was equal to 30 percent of the book value of Sub Company.

Sub Company sold inventory for $300,000,$262,500 and $337,500 in the years 20X6,20X7,and 20X8 respectively.Par Company reported ending inventory of $105,000,$157,500 and $180,000 for 20X6,20X7,and 20X8 respectively.Par acquired 70 percent of the ownership of Sub on January 1,20X6,at underlying book value.The fair value of the noncontrolling interest at the date of acquisition was equal to 30 percent of the book value of Sub Company.

-Based on the information given above,what will be the income to noncontrolling interest for 20X8?

Definitions:

Free Rider

An individual who benefits from resources or services without directly contributing to the cost or effort involved in their provision.

Marriage

Is a socially approved, presumably long-term sexual and economic union between two people. It involves reciprocal rights and obligations between spouses and between parents and children.

Intense Involvement

A high degree of engagement or commitment to an activity, cause, or interest, often exceeding the normative level of participation.

Vegan Potlucks

Social gatherings where individuals share and consume dishes that are entirely plant-based, fostering community among those following a vegan lifestyle.

Q6: The employee's earnings record provides information for

Q9: Based on the information given above,what amount

Q10: Form 10-K<br>A)Provides preliminary information to investors about

Q14: Mason Company paid its annual property taxes

Q19: Based on the preceding information,what amount will

Q25: On January 2,20X5,Park Co.purchased 10 percent of

Q32: Based on the information given,what balance in

Q38: Based on the preceding information,in the entry

Q42: Regulation D of the SEC presents important

Q60: ASC 280 requires certain disclosures about major