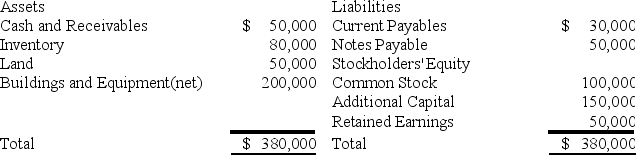

On January 1,20X9,Paradox Company acquired all of Sirius Company's common shares,for $365,000 cash.On that date,Sirius's balance sheet appeared as follows:

The fair values of all of Sirius's assets and liabilities were equal to their book values except for inventory that had a fair value of $85,000,land that had a fair value of $60,000,and buildings and equipment that had a fair value of $250,000.Buildings and equipment have a remaining useful life of 10 years with zero salvage value.Paradox Company decided to employ push-down accounting for the acquisition.Subsequent to the combination,Sirius continued to operate as a separate company.

The fair values of all of Sirius's assets and liabilities were equal to their book values except for inventory that had a fair value of $85,000,land that had a fair value of $60,000,and buildings and equipment that had a fair value of $250,000.Buildings and equipment have a remaining useful life of 10 years with zero salvage value.Paradox Company decided to employ push-down accounting for the acquisition.Subsequent to the combination,Sirius continued to operate as a separate company.

-Based on the preceding information,what amount of differential will arise in the consolidation process?

Definitions:

Caregiving

The act of providing direct support, assistance, and care to individuals who are unable to fully care for themselves, often due to illness, disability, or aging.

Type 1 Diabetes

An autoimmune condition where the pancreas produces little or no insulin, requiring insulin administration for management.

Type 2 Diabetes

A long-lasting disease identified by the body's resistance to insulin and elevated glucose levels, frequently linked to overweight and behavioral elements.

Genetic Component

A part of an individual's traits or conditions that is determined by genes inherited from their parents.

Q1: For FUTA purposes,the cash value of remuneration

Q2: Pratt Corporation owns 75 percent of Swan

Q11: Based on the preceding information and assuming

Q26: Employees paid biweekly receive their remuneration every

Q35: The garnishment that takes priority over all

Q36: Based on the information given above,what amount

Q40: Based on the preceding information,what was the

Q48: Based on the preceding information,the differential implicit

Q49: An employer is required to submit a

Q59: On January 1,20X7,Pepper Company acquired 90 percent