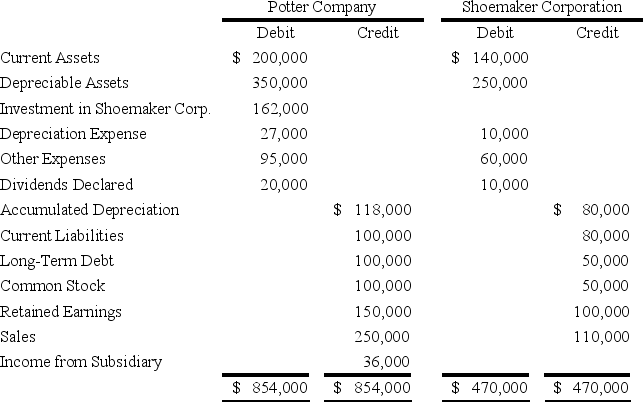

On January 1,20X8,Potter Corporation acquired 90 percent of Shoemaker Company's voting stock,at underlying book value.The fair value of the noncontrolling interest was equal to 10 percent of the book value of Shoemaker at that date.Potter uses the fully adjusted equity method in accounting for its ownership of Shoemaker.On December 31,20X9,the trial balances of the two companies are as follows:

-Based on the preceding information,what amount would be reported as total assets in the consolidated balance sheet at December 31,20X9?

Definitions:

Generally Accepted Accounting Principles

A set of accounting standards and procedures that are used to compile financial statements, ensuring consistency, reliability, and comparability of financial reporting.

Relevance

The quality of information that makes it useful for decision-making, implying that the information has the ability to influence the decisions of its users.

Future Events

Instances or occurrences that have not yet happened but are expected or anticipated to occur.

Adjusted Trial Balance

A trial balance taken after adjusting entries have been posted, showing the balances of all accounts including the adjustments for accruals and deferrals.

Q1: Infinity Corporation acquired 80 percent of the

Q5: Based on the information provided,what amount would

Q21: Puzzle Corporation acquired 100 percent of the

Q26: Based on the preceding information,the entries on

Q41: Based on the preceding information,what amount will

Q46: Based on the preceding information,what amount will

Q47: If 1 British pound can be exchanged

Q55: Based on the preceding information,what is the

Q62: Based on the information given above,what inventory

Q64: Hourly employees who take work home without