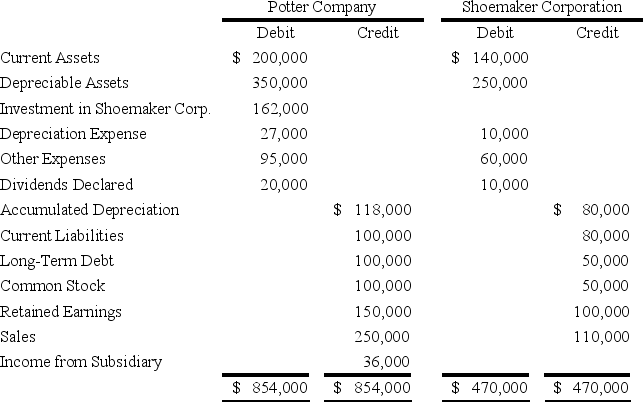

On January 1,20X8,Potter Corporation acquired 90 percent of Shoemaker Company's voting stock,at underlying book value.The fair value of the noncontrolling interest was equal to 10 percent of the book value of Shoemaker at that date.Potter uses the fully adjusted equity method in accounting for its ownership of Shoemaker.On December 31,20X9,the trial balances of the two companies are as follows:

-Based on the preceding information,what amount would be reported as noncontrolling interest in the consolidated balance sheet at December 31,20X9?

Definitions:

Annual Cash Inflow

The total amount of money received by a company over a year, including revenues from sales, investments, and other sources.

Net Present Value

An economic indicator that finds the disparity between cash inflows' present value and the present value of cash outflows during a certain period.

Discount Rate

A rate used to determine the present value of future cash flows; it's often used in discounted cash flow analysis to account for the time value of money.

Net Present Value

The variance between cash inflows and outflows' present value over time, utilized to evaluate an investment's profitability.

Q4: A subsidiary issues bonds.The parent can then

Q15: Based on the information given above,what was

Q19: Of the two main methods of withholding,only

Q23: All of the following statements accurately describe

Q26: Based on the preceding information,the increase in

Q29: FICA Taxes Payable-OASDI is a liability account

Q30: Based on the information given above,what amount

Q46: Exempt professional employees are exempt from all

Q50: Based on the preceding information,the entries on

Q51: Based on the preceding information,what amount of