On January 1,20X7,Passport Company acquired 60 percent of the outstanding common stock of Stamp Company at the book value of the shares acquired.On that date,the fair value of noncontrolling interest was equal to 40 percent of book value of Stamp.At the time of purchase,Stamp had common stock of $1,000,000 outstanding and retained earnings of $800,000.

On December 31,20X7,Passport purchased 50 percent of Stamp's bonds outstanding which were originally issued on January 2,20X4,at 99.The total bond issue has a face value of $600,000,pays 10 percent interest annually,and has a 10-year maturity.Any premium or discount is amortized on a straight-line basis.Passport paid $306,000 for its investment in Stamp's bonds and intends to hold the bonds until maturity.

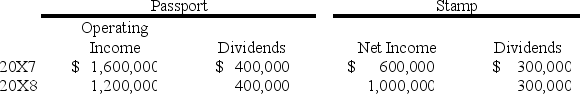

Income and dividends for Passport and Stamp for 20X7 and 20X8 are as follows:

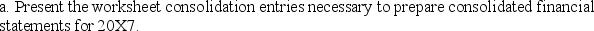

b.Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X8.

Definitions:

Invested Capital

The total amount of money that shareholders and debt holders have invested in a company for long-term use.

Gross Assets

The total asset value on a company's balance sheet before deducting any liabilities or depreciation.

Capital Asset Ratio

This ratio measures a bank's financial strength by comparing its capital to its assets, assessing the bank's ability to withstand losses.

IRS Regulations

Rules and guidelines issued by the Internal Revenue Service that govern how taxes should be paid and reported in the U.S.

Q1: Based on the information given,what amount will

Q6: Based on the information given above,what amount

Q7: Under enterprise coverage,all employees of a business

Q11: Poppy Corporation acquired 80 percent of Seed

Q20: The FLSA contains detailed specifications of the

Q28: Based on the preceding information,what is the

Q29: Based on the preceding information,what amount of

Q39: For which of the following payments is

Q46: On January 1,20X8,Alaska Corporation acquired Mercantile Corporation's

Q48: If instead,Poke could not exercise significant influence