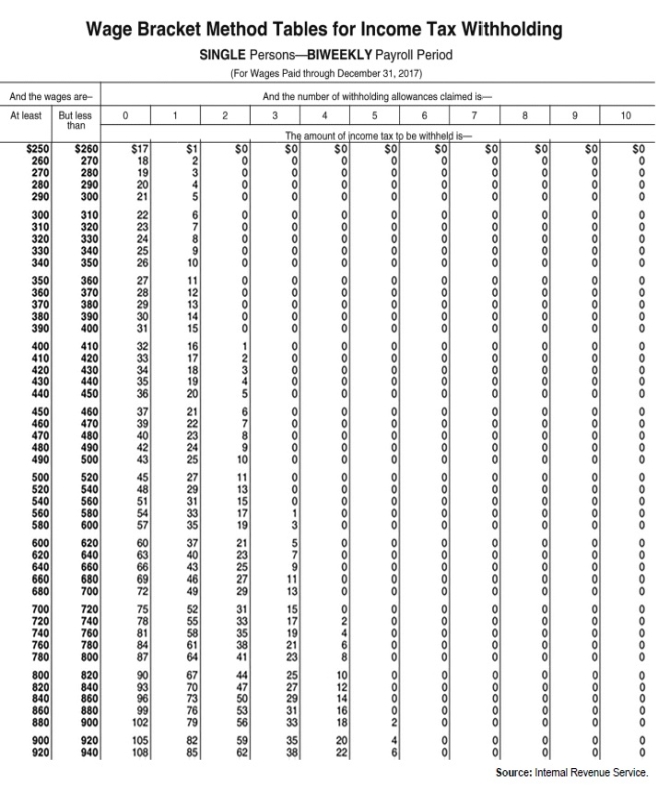

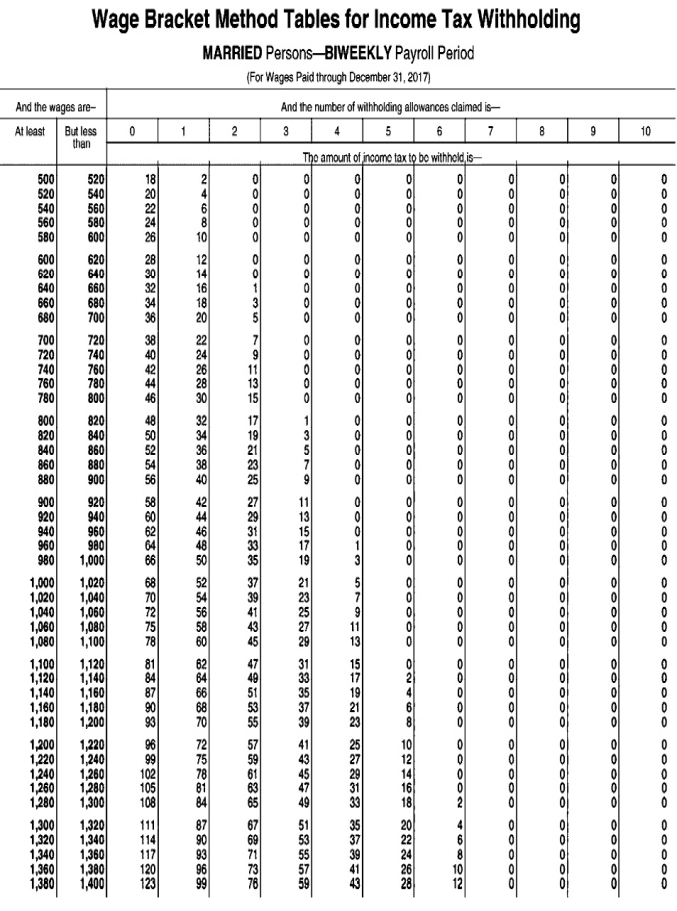

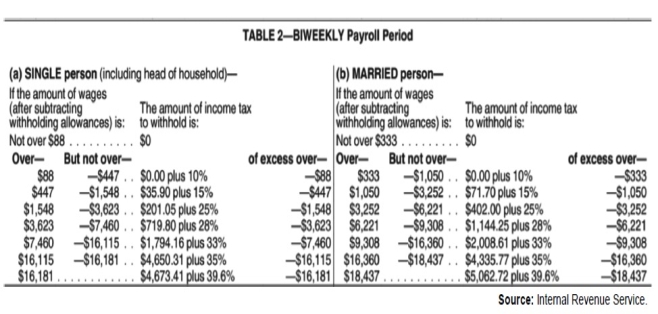

Exhibit 4-1:

Use the following tables to calculate your answers.

-Refer to Exhibit 4-1.Use the appropriate table to determine the amount to withhold for federal income tax from each of the following biweekly wages (biweekly withholding allowance = $155.80): Patrick Patrone (single, 2 all owances), wages__________

Carson Leno (married, 4 allowances), wages______________

Carli Lintz (single, 0 allowances), wages______________

Gene Hartz (single, 1 allowance), wages____________

Mollie Parmer (married, 2 allowances), wages___________

Definitions:

Instrument Of The State

A term used to describe organizations or individuals that carry out the directives and policies of the government, often in an authoritative or regulatory capacity.

Social Change

The transformation over time in the institutions, culture, and structure of society.

Subculture

A group within society that is differentiated by its distinctive values, norms, and lifestyle.

Fan-Celebrity Relationships

The dynamic and often parasocial interaction between fans and celebrities, characterized by varying degrees of adulation, obsession, and personal attachment.

Q8: The Social Security Act ordered every state

Q17: Peter,age 17 and employed by his family-owned

Q29: Based on the information given above,what amount

Q47: The _ is the entity who designates

Q58: If an employer's quarterly tax liability is

Q59: Training sessions are counted as working time

Q93: One of the provisions of the Affordable

Q156: List the factors that go into a

Q183: A guaranteed insurability rider allows you to

Q188: Your grandmother has just turned 65 years