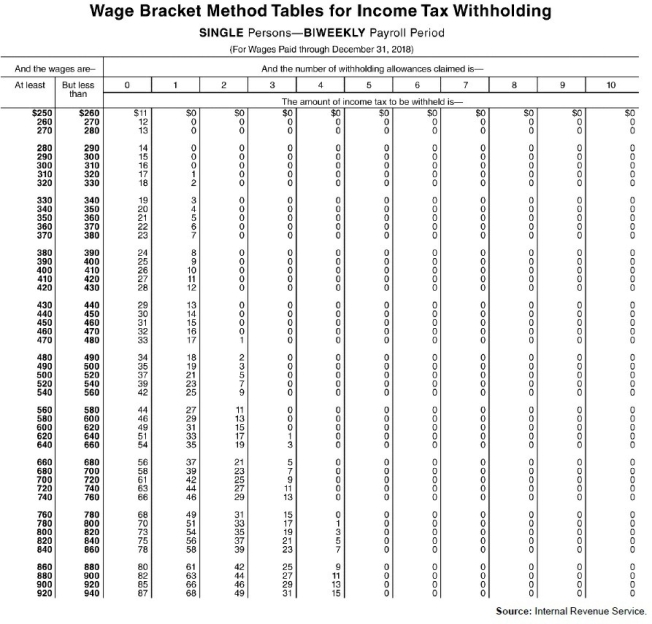

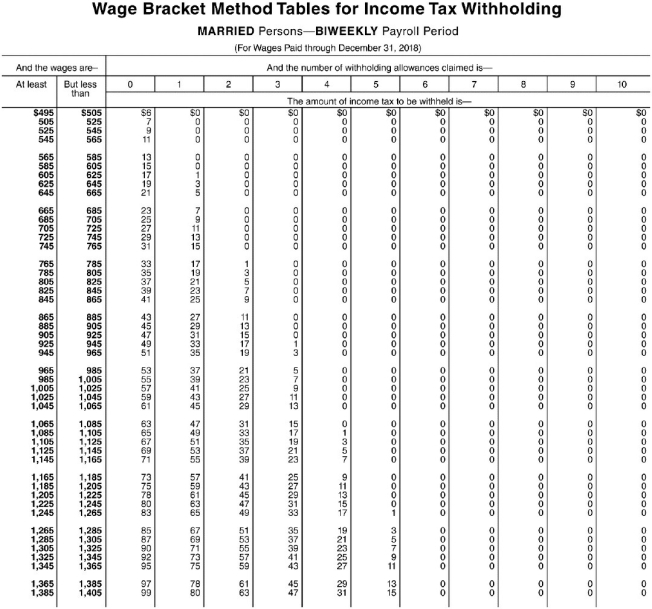

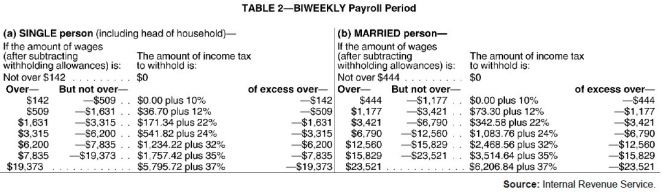

Exhibit 4-1:

Use the following tables to calculate your answers.

-Refer to Exhibit 4-1.Carson Smart is paid $1,200 every two weeks plus a taxable lodging allowance of $100.He is a participant in the company 401k) plan and has $150 deducted from his pay for his contribution to the plan.He is married with two allowances.How much would be deducted from his pay for federal income tax using the wage- bracket table)?

Definitions:

Electronic Communication

The transfer of information using electronic mediums such as email, social media, and online messaging platforms.

Bridal Salon

A specialized retail store that sells bridal wear, including wedding dresses and accessories.

Liquidate

To convert assets into cash or cash equivalents by selling them on the open market.

Channel Richness

The capacity to communicate and understand information between people and organizations.

Q1: How can you benefit from following the

Q12: Based on the information provided,what amount of

Q31: On January 1,20X7,Passport Company acquired 60 percent

Q42: Based on the information given above,what amount

Q42: In order to obtain the maximum credit

Q43: Which of the following is a provision

Q44: Refer to Instruction 2-1.Jose Cruz earns $2,275

Q61: There are no states that allow employees

Q68: Each year,the FICA (OASDI portion)taxable wage base

Q115: Candice is purchasing a new Jeep.She has