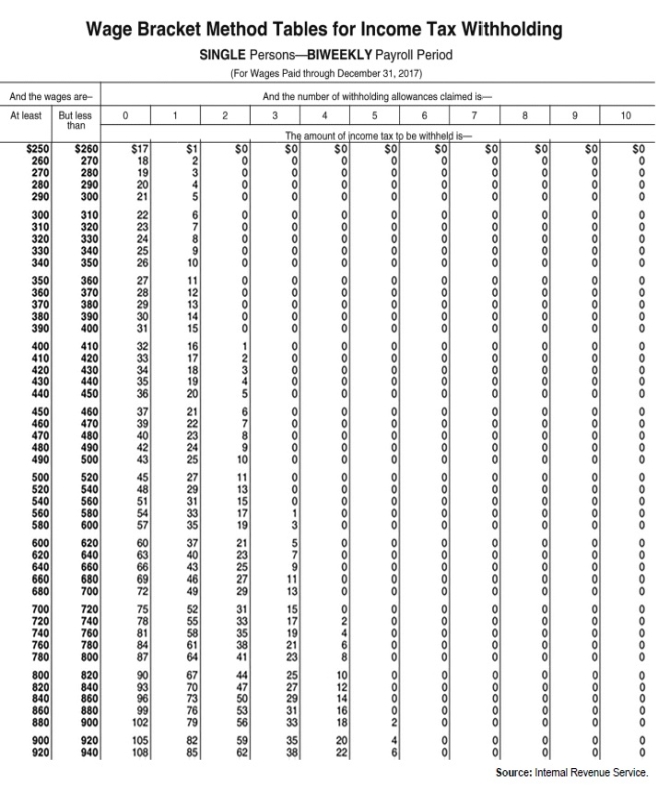

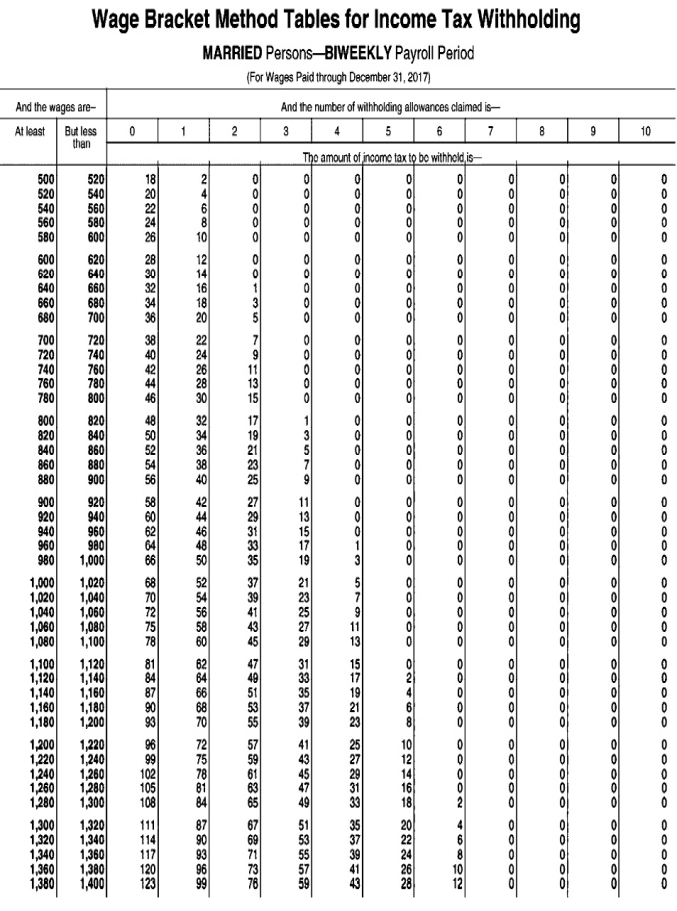

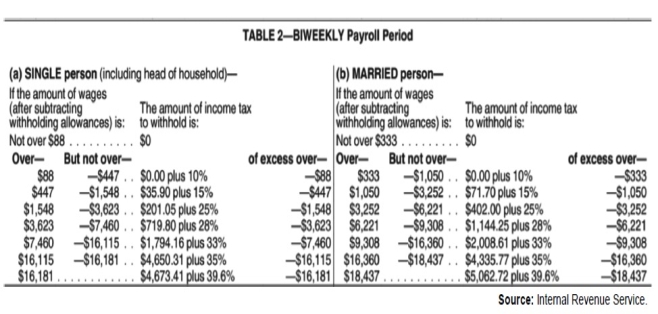

Exhibit 4-1:

Use the following tables to calculate your answers.

-Refer to Exhibit 4-1.Use the appropriate table to determine the amount to withhold for federal income tax from each of the following biweekly wages (biweekly withholding allowance = $155.80): Patrick Patrone (single, 2 all owances), wages__________

Carson Leno (married, 4 allowances), wages______________

Carli Lintz (single, 0 allowances), wages______________

Gene Hartz (single, 1 allowance), wages____________

Mollie Parmer (married, 2 allowances), wages___________

Definitions:

Q7: Employees are liable for their FICA taxes

Q14: When recording the deposit of FUTA taxes

Q21: A monthly depositor is one who reported

Q24: Before any federal income taxes may be

Q26: Employees paid biweekly receive their remuneration every

Q33: Under FICA only,cash tips of more than

Q38: Based on the preceding information,what amount will

Q39: Based on the preceding information,what is the

Q61: There are no states that allow employees

Q197: Surgical insurance covers the cost of surgery.A