Two manufacturing business entities (A and B) were created at the same time this year and started operating on the very same day.They operate on two absolutely identical but separate worlds,but are not in competition with one another.They are absolutely identical in terms of their market success,their productive technology,equipment and infrastructure.They have the same headcount comprising the same categories of skills and competence.Both must pay cash for all their purchases.

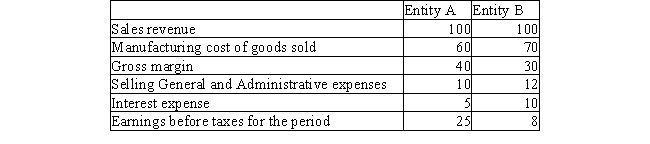

The first year's income statements for each firm are as follows:

Which of the following statements is entirely true:

Definitions:

Book Income Tax Expense

The amount of income tax a company reports in its financial statements, which may differ from the tax owed to tax authorities.

Deferred Tax Asset

An accounting term for items that reduce future tax liability because of temporary differences between the book value and the tax value of assets and liabilities.

Future Taxable Income

The income that a company or individual expects to earn in future periods that will be subject to tax.

Probability

A measure of the likelihood of a specific event happening, expressed as a number between 0 and 1.

Q2: Which of the following will most likely

Q4: Initial financial resources are provided by:<br>A) Customers<br>B)

Q11: How does one describe the way a

Q13: What is the unsystematic cost allocation called?<br>A)

Q16: Which of the following statements is true?<br>A)

Q17: IAS 16 defines an 'impairment loss' as

Q21: The decision regarding what to do with

Q33: Which of the following statements is not

Q67: Benchmarking common size variables against a key

Q187: A day trader typically sits at a