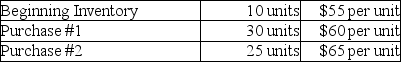

Carboni Company had the following data available for the current month:

Assume 40 units were sold during the month.Sales Revenue for the month is $7,000 and operating expenses are $2,200.The income tax rate is 30%.

Assume 40 units were sold during the month.Sales Revenue for the month is $7,000 and operating expenses are $2,200.The income tax rate is 30%.

Required:

Compute cost of goods sold using:

a.FIFO

b.LIFO

Definitions:

Demand Curve

A graphical representation that shows the relationship between the quantity of a good or service consumers are willing and able to purchase and its price.

Excess Demand

A market condition where the quantity demanded of a good exceeds the quantity supplied at a given price, often leading to price increases.

Supply

The total quantity of a good or service that the market can offer.

Demand

The amount of a product or service that consumers are willing and able to purchase at various prices during a specified period.

Q40: The book value of an asset cannot

Q54: Which of the following statements regarding contracts

Q86: David Corporation issued $80,000,5-year bonds at 98

Q94: Marshall Corporation has $31,000 of bonds outstanding

Q105: On January 2,2019,Konan Corporation acquired equipment for

Q106: Bonds with a face value of $200,000

Q122: The inventory turnover ratio should be the

Q130: The ending bank statement balance at November

Q149: With regard to customer checks received by

Q181: On January 2,2019,Konrad Corporation acquired equipment for