Carboni Company had the following data available for the current month:

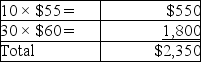

FIFO Cost of Goods Sold:

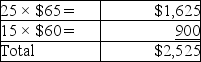

LIFO Cost of Goods Sold:

LIFO Cost of Goods Sold:

The income tax rate is 30%.

The income tax rate is 30%.

Required:

How much would Carboni Company save in income taxes if they used LIFO instead of FIFO?

Definitions:

Problems

Problems are obstacles, discrepancies, or uncertainties that necessitate solutions or decisions, often requiring analysis, creativity, and strategic thinking to resolve.

Decision Making Process

A step-by-step approach to choosing between alternatives to achieve a goal or solve a problem, involving stages such as problem identification, generating options, and selecting the best solution.

Generating Alternative Solutions

The process of brainstorming or devising multiple options or approaches to solve a problem or address a situation.

Preferred Solution

The most desirable option or course of action among a set of alternatives based on specific criteria or objectives.

Q46: Given the following data,calculate the cost of

Q67: An internal control system can be circumvented

Q72: A company purchased inventory for $1,300 per

Q84: Which intangible asset is NOT amortized?<br>A)patents<br>B)trademarks<br>C)copyrights<br>D)goodwill

Q91: The journal entry to record a cash

Q105: Outstanding checks are checks that have been

Q109: A potential obligation that depends on the

Q117: The revenue principle deals with the following:<br>A)when

Q175: The long-term asset that is not depreciated

Q176: The revenue principle requires that a business