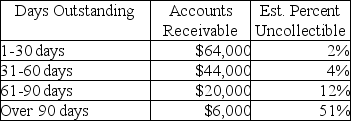

A year-end review of Accounts Receivable and estimated uncollectible percentages revealed the following:  Before the year-end adjustment,the credit balance in Allowance for Uncollectible Accounts was $900.Under the aging-of-receivables method,the balance in the Allowance for Uncollectible Accounts will be ________ after the adjusting entry is made.

Before the year-end adjustment,the credit balance in Allowance for Uncollectible Accounts was $900.Under the aging-of-receivables method,the balance in the Allowance for Uncollectible Accounts will be ________ after the adjusting entry is made.

Definitions:

Inventory

The sum of all goods and materials held by a company in stock, including raw materials, work-in-progress, and finished goods.

Investment Expenditures

Spending on capital goods by firms and households which will be used for future production of goods and services.

GDP Accounting

A method used to calculate the gross domestic product of a country, summing up the total value of all goods and services produced over a specific time period.

Tangible Goods

Tangible goods are physical items that can be touched and seen, distinguished from services or digital products.

Q15: When an adjustment is made for prepaid

Q33: On January 2,2019,Helmkamp Company purchased a $30,000

Q38: A purchaser is willing to pay for

Q41: The Allowance for Uncollectible Accounts has a

Q53: Sales taxes collected from customers are sent

Q60: A receiving report:<br>A)identifies the need for merchandise

Q75: What is the distinction between a capital

Q90: The direct write-off method records Uncollectible-Account Expense:<br>A)in

Q178: To account for the disposal of a

Q197: At December 31,the NBC Company owes an