At December 31 of the current year,Accounts Receivable has a balance of $900,000,the Allowance for Uncollectible Accounts has a debit balance of $1,000 and net credit sales for the year are $3,000,000.The company uses the percent-of-sales method.Its credit department has determined that uncollectible accounts will amount to 2% of net credit sales.

Required:

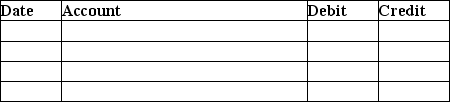

1.Prepare the year- end adjusting journal entry.Omit the explanation.

2.Determine the adjusted balances for Accounts Receivable and the Allowance for Uncollectible Accounts.

2.Determine the adjusted balances for Accounts Receivable and the Allowance for Uncollectible Accounts.

3.Determine the net realizable value of accounts receivable at the end of the year.

Definitions:

Rancher

A person who owns or manages a ranch, where livestock such as cattle or sheep are raised for meat or wool.

Production Possibilities

A curve depicting all maximum output possibilities for two goods, given a set of inputs consisting of resources and other factors.

Opportunity Cost

Forgoing possible gains from alternative paths when one path is chosen.

Farmer

An individual engaged in agriculture, raising living organisms for food or raw materials.

Q17: Accounts receivable are reported on the balance

Q19: a.What does the net profit margin ratio

Q38: Barker Enterprises paid $30,000 cash for a

Q73: Which is NOT a component of comparisons

Q76: Olde Shoppe has the following information at

Q88: Land improvements include expenditures for:<br>A)paving the parking

Q90: Ending inventory for the year ended December

Q113: Why does U.S.GAAP require companies to apply

Q140: The gross profit percentage is calculated as:<br>A)cost

Q153: The maker of a note is the