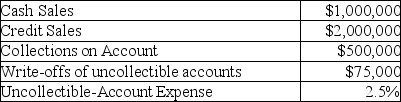

During its first year of operations,Ness Company had the following transactions.The company uses the percent-of-sales method to estimate uncollectible accounts.

Required:

Required:

Prepare all journal entries for these transactions.Explanations are not required.Ignore Cost of Goods Sold.

Definitions:

Scrap Value

An estimated calculation of what an asset will be worth at the time it is sold, after it is no longer useful.

Sum-Of-The-Years-Digits

An accelerated method of depreciation which totals the digits of an asset's useful life and allocates the cost based on a fraction of those digits.

Scrap Value

The calculated resale value of an asset at the termination of its functional life.

MACRS Tables

Guidelines used in the United States for calculating depreciation deductions for tax purposes under the Modified Accelerated Cost Recovery System.

Q11: The bookkeeper recorded a payment on account

Q32: The general ledger has a separate account

Q34: Days' sales in receivables is also called:<br>A)days'

Q59: The following accounts and balances are taken

Q82: On December 31,2019,Accrued Warranty Payable is reported

Q101: Which of the following costs for a

Q117: The primary way that fraud is prevented,detected,or

Q131: Seidner Store sells expensive watches.An inventory at

Q136: Smith Company returned $20,000 of inventory to

Q171: Equipment costing $40,000 with a book value