Consider the following INDEPENDENT situations for Tommy Company:

a.The Allowance for Uncollectible Accounts has a $1,200 credit balance prior to adjustment.Net credit sales during the year are $830,000 and 2% are estimated to be uncollectible.Accounts Receivable has a balance of $110,000 at the end of the year.The company uses the percent-of-sales method.

b.The Allowance for Uncollectible Accounts has a $900 credit balance prior to adjustment.Based on an aging schedule of accounts receivable prepared at the end of the year,$20,000 of accounts receivable are estimated to be uncollectible.Accounts Receivable has a balance of $104,000 at the end of the year.

c.The Allowance for Uncollectible Accounts has a $16,300 debit balance prior to adjustment.Based on an aging schedule of accounts receivable prepared at the end of the year,$200,000 of accounts receivable are estimated to be uncollectible.Accounts Receivable has a balance of $958,000 at the end of the year.

d.The Allowance for Uncollectible Accounts has a $500 credit balance prior to adjustment.Net credit sales during the year are $900,000 and 1% are estimated to be uncollectible.Accounts Receivable has a balance of $825,000 at the end of the year.The company uses the percent-of-sales method.

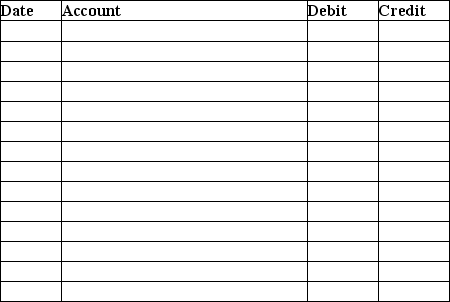

Required:

Prepare the adjusting journal entries for uncollectible accounts for each INDEPENDENT situation.Explanations are not required.

Definitions:

Perfectly Negatively Correlated

A relationship between two variables where one variable increases as the other decreases with a correlation coefficient of -1.

Global Minimum Variance Portfolio

A portfolio construction strategy aimed at minimizing the volatility of returns by selecting a combination of investments that as a whole have the lowest possible risk.

Standard Deviation

A statistical measure of the dispersion or variability of a set of values, often used to quantify the risk associated with a particular investment or portfolio.

Optimal Risky Portfolio

According to modern portfolio theory, this portfolio provides the maximum expected return for a specific risk level or minimizes the risk for a set expected return.

Q1: According to FASB,when should a contingent liability

Q29: The Schauer Company had the following adjustments

Q30: Company A has inventory out on consignment

Q31: Under the revenue recognition principle,you can recognize

Q77: The revenue principle states that revenue should

Q80: The closing entry for the Salaries Expense

Q95: At the end of its useful life,the

Q101: The Sally Company has the following data

Q138: Like U.S.GAAP,asset impairments under IFRS may be

Q160: Which is NOT an objective of an