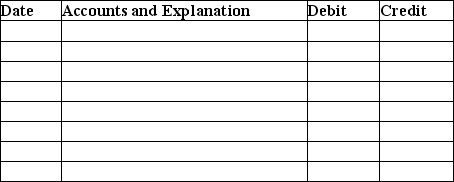

Prepare the journal entry(ies)for the following transactions:

May 2,2019: Main Street Enterprises purchased office supplies,for $2,000,on account.

June 2,2019: Main Street paid for the supplies.

Definitions:

Legally Divorced

A status that indicates a person has completed the legal process of divorce, thereby dissolving the marital relationship under law.

Full-Time Student

A student who is enrolled in a higher education institution for the number of hours or courses the school considers to be full-time attendance.

Own Support

Refers to the financial contribution made by an individual towards their own living expenses, potentially affecting tax filing status and dependency exemptions.

Exemption

Deductions allowed by law to reduce taxable income based on taxpayer and dependent information.

Q29: The Schauer Company had the following adjustments

Q43: On January 1,2019,Exclusive Company purchases $10,000 of

Q81: Specialty Foods Company maintains a separate accounts

Q83: A noncontrolling interest arises in all consolidations,regardless

Q92: Which statement about the statement of cash

Q130: The ending bank statement balance at November

Q160: Why is the income statement prepared first

Q167: When a business factors its receivables,the factor

Q169: Historical Art is a new business.During its

Q195: A company receives an utility bill and